Godspeed Capital is a compelling partner for founders, entrepreneurs, and management teams due to its unique, partner-friendly investment approach.

Strategy

A Compelling Partner for Leaders & Teams

Deep Sector Focus Expertise

The Godspeed Team has over 35 years of Defense & Government related investment experience. We perform as a strategic partner, providing management teams with relevant subject matter expertise, M&A experience, financial proficiency, and access to resources.

Long Term Partner

Godspeed does not have typical private equity timeline requirements and therefore can be a long-term partner for our management teams. We can truly focus on investing for the future.

Flexible Capital

Investments are structured to meet the strategic needs and plans of a target company. We focus on control buyouts, buy & builds, corporate carve-outs, and special situations.

Team Oriented

People are the absolute key critical element of success in business and as such we place a premium on building strong, cohesive management teams, while also investing in and developing our people at all levels of an organization.

Operational Experience

Godspeed’s objective is to partner with founder and management owned and operated businesses that have reached an inflection point in their trajectory. By teaming with management, Godspeed is able to drive growth and value creation through strategic initiatives, operational improvements, technology investments, and add-on acquisitions.

Giving Back

Godspeed believes in giving back to those who keep us safe – as such we contribute a meaningful share of our profit annually to charitable causes that help support our service men and women in uniform, and their families.

Sectors We Target

Based on underlying sub-sector growth trends, Godspeed Capital pursues investment opportunities across the Defense & Government services, solutions, and technology related markets in areas that include, but are not limited to:

Cybersecurity

Intelligence Analysis

Hypersonics

Cloud Computing

Healthcare IT

Defense Technology

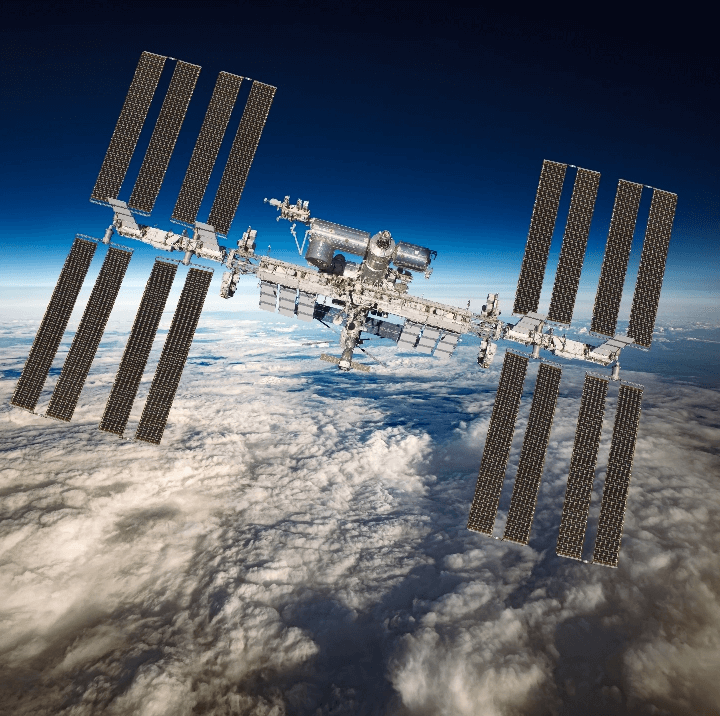

Space

Software Engineering

Engineering, Technical & Professional Services

Intelligence Surveillance & Reconnaissance

Artificial Intelligence

Mission Support & Logistics

Godspeed Capital targets investments with the following characteristics:

Control

Godspeed is a Control Investor

Geography

While our target businesses are international in scope, Godspeed focuses on companies headquartered in North America

Transaction Size

$3 to $30 million in EBITDA

Transaction Type

- Private company buyouts

- Niche sector consolidation / roll-up strategies

- Add-on acquisitions

- Partnering with entrepreneurs to provide capital and strategic guidance for expansion

- Public-to-private transactions

- Corporate carve-outs

- Special Situations

Connect with Godspeed

Connect with Godspeed Capital to further discuss our portfolio companies, acquisition ideas (new platforms and add-ons), and innovative technologies and services we may be interested in.

Contact Us